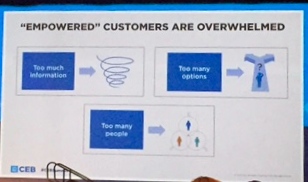

Last week Tibor Shanto from Renbor Sales Solutions mentioned in his post that I questioned the value of the sales organization. Given the information shared with us at the CEB Sales and Marketing Roundtable meeting we attended, the question was relevant. He goes on to state that what I was really asking is why are so many sales reps struggling and what could marketing do to help them succeed. If the sales organization struggles, most likely marketers will struggle, and they may be the ones who will get the blame.

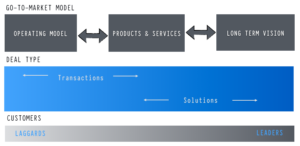

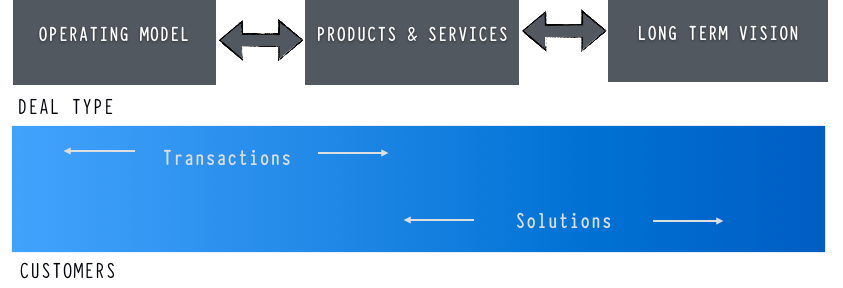

The more I thought about it the more convinced I became that the issue goes beyond sales and marketing, and their ability to correct it. I don’t think marketing can fix what ails sales, and vise versa. To illustrate the issue, I have created a framework that oversimplifies an organization go-to-market model. The core of the GTM model is the operating model, the product and services group and the organizations long-term vision.

Each part of the model plays an important role in determining the success of an organization. Additional detail on each group is contained below.

- Operational Model – the core of the business, how it delivers value to customers. It is also focused on driving efficiency and effectiveness in the delivery model.

- Product/Services – the physical manifestation of the value.

- Vision – how the company articulates their view of the world, now and in the future based on consumer/customer, competitor and market trends and needs.

Marketing develops and articulates the organization’s vision. It should be forward looking (at least three years), and challenge the product organization to “catch up.” It should enable the sales force to sell new solutions, enter new markets and differentiate the organization against competitors.

The product group builds, tests and perfects products, services and solutions that meet the needs of buyers today, and in the future. It should be able to define the market opportunity and the best route to capture it.

The “operating model” should be constantly evaluating those products and services most strategic to the organization (revenue, profit, etc.) and how to scale them. In some of the best organizations I’ve seen, this group enable the “visionary” solution sales reps to sell whatever they want early in a “wave,” as it works to pair down offerings to the few that are the most desired (market demand and/or profitability) As a result, choice, selection and pricing are simplified which helps them scale and enables the sales force to sell efficiently.

Aligning The Sales Organization

Solution Sales team – the solution selling team should be aligned to the front end of the go-to-market model. They have the capability, experience and navigation skills to configure and sell the vision and complex solution, both to internal and external audiences.

Product Specialist and Account Management teams – AM’s or PS’s are aligned to existing accounts and/or products and may be aligned by industry or type of solution. Their goal is to keep and expand the account. Reps that excel in this role are adept at understanding how to navigate the internal workings of the client — how to work the procurement process, position their products/organization against competitors, gain access to new buyers/opportunities, and how to anticipate future needs.

Telesales and Online Portals – the back end of the go-to-market framework where the “operating model” has shifted low margin “simple” products, to align with knowledgeable buyers. Allowing them to make a purchase transaction at the lowest cost and in the most convenient way possible. Sales reps may also dealing with “laggard” first time buyers who come late to a product or solution and have simple requirements.

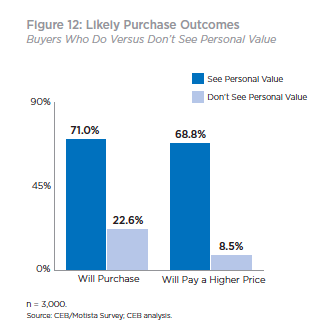

Marketing’s role across this continuum varies. For the solution sellers, content marketing is critical and as Tibor states “insights built around business objectives.” Marketing has to help the sales organization articulate the organization’s vision (“air cover”) and the value of the product to the buyer, professionally and personally.

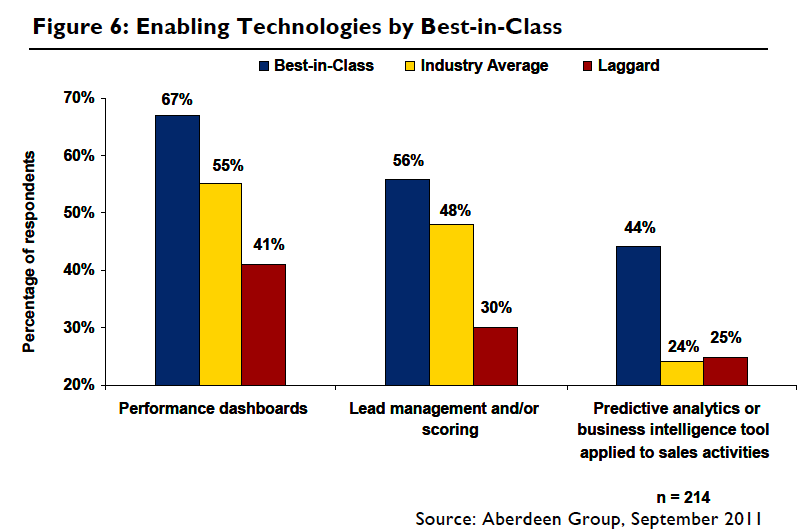

So what’s different about the sales model I laid out? Nothing. Does sales need a new model? Maybe, maybe not, but what it needs right now is the organizations commitment to executing the model that I just described. It isn’t throwing more resources and technology at sales, as the CEB research points out. Almost all (98%) of the sales leaders surveyed by CEB had added resources for sales support over the last four years, yet 76% of sales reps said that they have experienced an increase in the complexity of the support they are receiving.

Organizations have to commit to being good at all parts of the go-to-market model. Many of the organizations shortcomings and/or dysfunctional behavior become sales inhibitors. For example, organizations that are operationally efficient often lack the ability to articulate a long-term vision. On the other end, companies that have their heads in the future often miss simple things like scaling down the number of products sold, or simplifying financing terms or compensation plans.

What I took away from the meeting is, in today’s complex business environment, those organization that can simplify buying will win. The problem is that it’s easier to add and feel like you’re making a difference than it is to subtract or reduce and know that you making progress. It’s time to stop feeling like you’re making a difference and start putting a shoulder to making it happen.

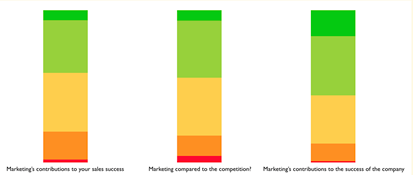

and the involvement of other decision makers in the process, according to

and the involvement of other decision makers in the process, according to  ta Points to Defend You 2015 Marketing Budget

ta Points to Defend You 2015 Marketing Budget