This time of year, America’s third or fourth (depending on where you live) most popular sport gets its moment in the sun. The Stanley Cup finals begin this week and the nation’s attention turns to ice, hockey sticks, pucks, and maybe mullets.

This time of year, America’s third or fourth (depending on where you live) most popular sport gets its moment in the sun. The Stanley Cup finals begin this week and the nation’s attention turns to ice, hockey sticks, pucks, and maybe mullets.

For business marketers, the “holy grail,” or in this case the “Stanley Cup,” has been trying to demonstrate the business impact of social media. Not defined by adoption, usage, or engagement, but by influence. Proving that social media and/or social networks can influence buyer behavior. New insight suggests that it might be time to lace up the skates and put on the pads.

Word of mouth (WOM), defined by person-to-person communication be that in person or over the phone, is and has always been the most used, and most influential channel for business buyers. Sometimes also described and measured as NPS (Net Promoter Score), it is the “Wayne Gretsky” of driving influence among decision makers, both in new acquisition, and for renewal.

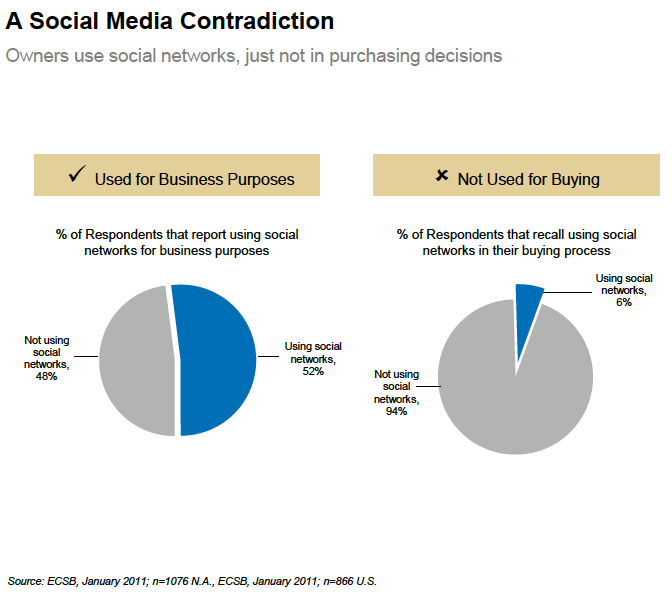

Unlike WOM, Social Media has struggled with demonstrating influence. Adoption and usage rates continue to grow, but the impact on B2B decision makers has been difficult to nearly impossible to measure (btw – this is not unlike other, more established media channels).

That was until now. Research from Buyersphere may give us a clue to how social media may influence decision makers in the near future, and it has given us a couple of “hockey sticks” and a “puck” to play with.

According to Buyersphere’s Annual Survey of B2B Buyer Behavior, even though buyers mention social media (and providers such as Twitter, Facebook and Linkedin) when asked to rate their usage and the usefulness of channels when searching for vendors, they fall off the grid when asked to evaluate their influence. As you would expect, word of mouth came out on top.

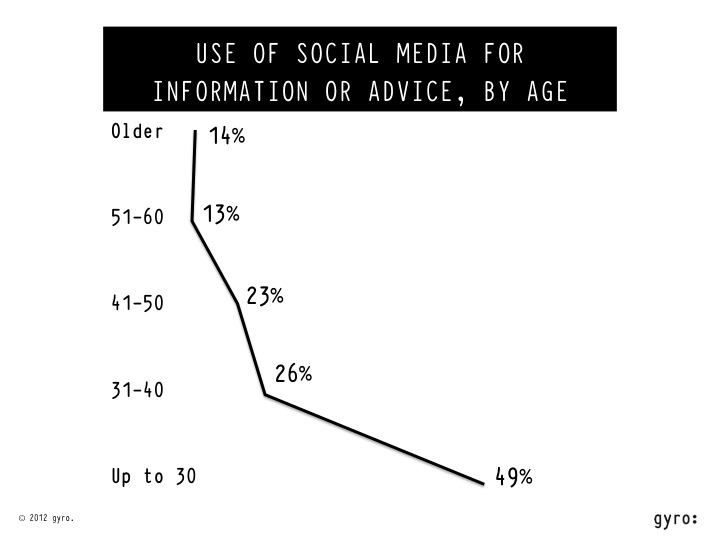

Diving deeper into the research, it revealed a few game changing findings. Twenty to thirty year olds (Gen Y), act like no other previous generations. The first “hockey stick” is somewhat known — twenty-something business buyers are roughly twice as likely to seek information or advice from social media as the generation before them (31-40 year olds). And almost four times more likely to than the baby boomers (51-60 year olds).

The second hockey stick, and the one that may end up being somewhat problematic for marketers, is that 49% of Millennials stated that they wanted to create and publish their own professional content. They not only want your content, but they also want to be able to disassemble it and repackage it with their own point of view.

The second hockey stick, and the one that may end up being somewhat problematic for marketers, is that 49% of Millennials stated that they wanted to create and publish their own professional content. They not only want your content, but they also want to be able to disassemble it and repackage it with their own point of view.

And finally, the puck to play with is that buyers under 30 are the only group that describe word of mouth as social media first, and then phone or in person. Close to 50% of Gen Y buyers defined WOM as any social media, in person or phone, mentioned by only 33% of the respondents. Buyers 40-50 by contrast, define WOM as in person or phone 60% of the time with any social media platform only 23%.

Game On

Marketers most powerful and influential channel is now being redefined, and this presents the best opportunity to date to demonstrate the impact of social media on buyer behavior. “To skate to where the puck is going to be” as Gresky used to say, we need to plan now.

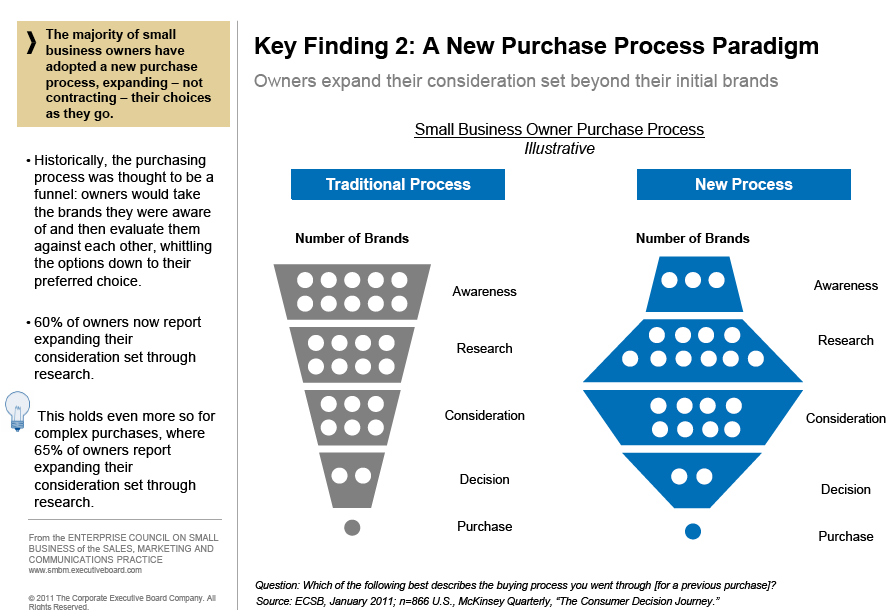

To define the approach we need to understand the components of “social media” that are often lumped together – social networks and social media. Social networks refer to the connection among users and their social structure (friend, business acquaintance, etc.).

Social media is defined as the online channel used to generate, access and distribute content. The distinction is important because of the way different generations of business buyers use and value them. This is key to unlocking influence.

We know that their social network heavily influences Gen Y, more than any other generation. We know that half of them want to produce and share their own content, 60% upload content to the web, and 62% rate products and services on the web.

So for Enterprise accounts, where Gen Y is 5-10 years from occupying the C-Suite, take a lesson from McDonalds and “grow your own customers.” Get Gen Y hooked on your content by involving them in your brand and making your content modular so it’s easy to repackage and share. The route to influence is through cause marketing efforts delivered via mobile devices. Thirty-seven percent of Millennials say they are drawn to products with co-branded campaigns.

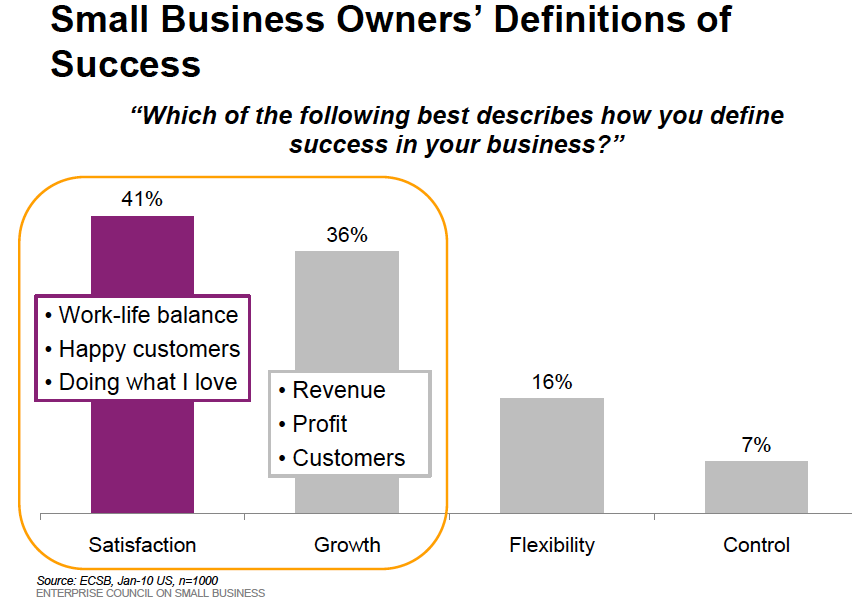

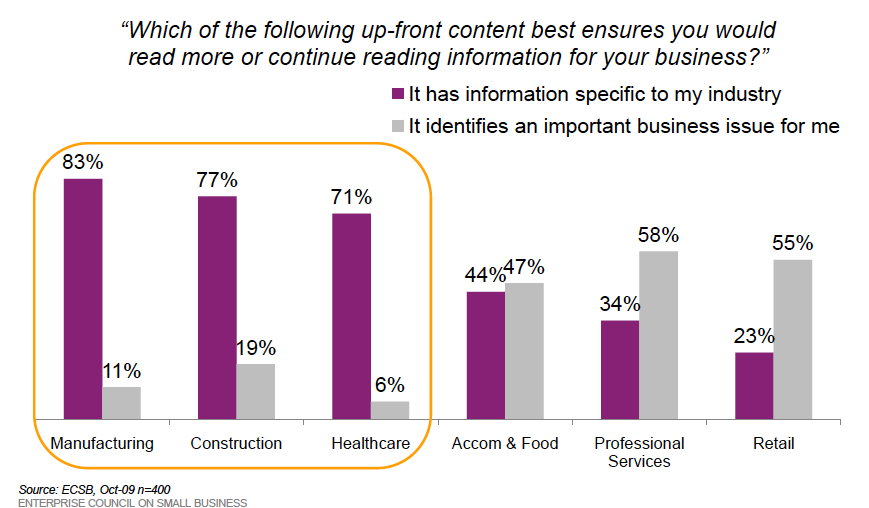

For small businesses, which Gen Y owns close to 1 out of 3, according to the Executive Council of Small Business (ECSB), the goal should be to make them advocate for your brand, product or services to their network. To do that, focus on issue resolution, the number one loyalty driver. For prospects, provide them with information that is useful.

According to the ECSB, the number one pain point for all small business owners is sales and customer acquisition; being twice as prevalent among Gen Y owners. Specifically, lead generation and successfully competing with other small business owners. Help them understand how your products and services can help them grow their business.

Even though there is potential for social media to deliver a real, tangible business impact, it will be similar to this championship series. It’s not going to be quick, expect to lose a game or two along the way, and to be successful you’ll need to take many shots on goal…hell, you may even lose a tooth or get a “shiner.”