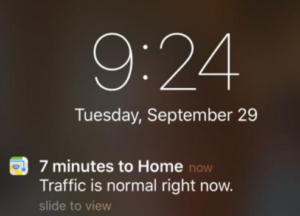

One morning a couple of months ago I got in the car and my phone said travel time to my office 20 minutes and traffic was normal. A new feature of iOS9 is the ability for Apple Maps to detect when you enter your car by syncing with Bluetooth. I didn’t find it invasion, in fact, living in one of the worst cities in the country for traffic, I welcomed the information.

One morning a couple of months ago I got in the car and my phone said travel time to my office 20 minutes and traffic was normal. A new feature of iOS9 is the ability for Apple Maps to detect when you enter your car by syncing with Bluetooth. I didn’t find it invasion, in fact, living in one of the worst cities in the country for traffic, I welcomed the information.

Now that I’ve had a taste of IoT and “things connecting to things” I want more, and it’s given me a glimpse of what the future of mobile advertising might look like. Ads will go from being disruptive to being useful, perhaps even helpful. Mobile devices will become your digital doppelgänger signaling to other devices your presence, preferences and patterns.

For example, I’m on my way to LA for a meeting. My United app holds my flight itinerary, terminal and gate, Google/Apple Maps knows my current location, and my Starbucks app knows my buying behavior. My phone holds my intent, location and past purchasing history that could trigger opportunities to give me promotional messages as I journey to my gate.

Given the early morning departure, I’m in desperate need of coffee. The wall-mounted screens on the “people mover” (in the future) could flash me offer as I pass, inviting me to stop at a convenient store location by my gate. In this new world, my order would be ready and waiting for me when I arrived. Being between two locations, and missing the closest one, I would of appreciate this information as I have no time to backtrack.

Here’s the point — we are quickly moving to the ultimate marketing goal of getting the right message, to the right person, at the right time, and in the right place. But to enable this future, which will be data driven and permission based, the challenge for marketers is — how do we enbable it and/or keep from screwing it up?

Here are four things to consider:

- Retargeting – we have to stop being “creepy” by being better at targeting and knowing when to turn the “switch off.” Enough said on this topic, I think we all know the issues. Trying to be “personal” without having a relationship will get you into trouble.

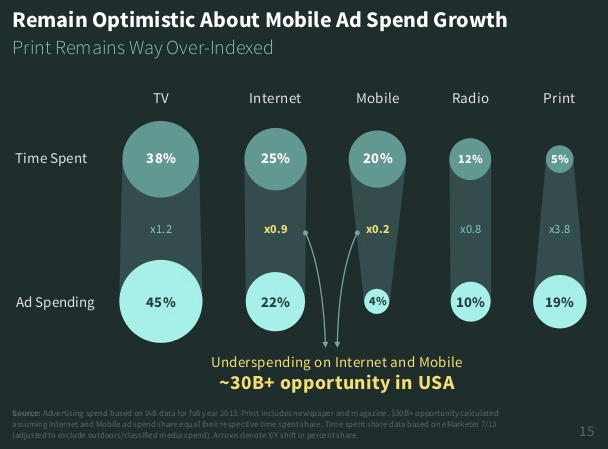

- Overemphasizing Acquisition – IAB reported that digital advertising increased by 20%, and mobile by 66%, in 2015. Yes, there are certain elements of digital that deserve the investment, but attribution issues still exist. Take a hard look at your revenue mix and understand the most productive lead sources. Place your bets on improving conversion metrics, not just increasing volume. Don’t create a bunch of unnecessary noise at the top of the funnel.

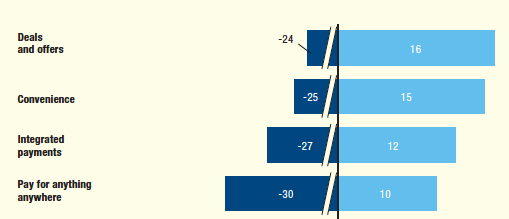

- Undervaluing Upsell, Cross Sell and Renewal – With a future built on “permissions” existing relationships are the perfect starting point. Invest in helping customers become better consumers by thinking for them. Reposition marketing activities from being interruptive to being helpful, innovative and informative. Proactively reach out to them with offers based on their behaviors, focusing on how it will help them in their role, and not necessarily how it directly benefits your organization. Trust me, it will come back to you.

- Scrutinize Technology Investments – ChiefMarTech estimates that there are now over 3500 MarTech providers. It’s a “killing field” as Larry Ellison once described it. Over the next 2-3 years companies will either 1) run out of money, 2) merge or 3) be acquired. Carefully consider and select partners that will help build new mobile platforms, capabilities and tracking. Invest the time to get to know their business/funding model, existing customer base, and account team.

In the near future, highly personalized ads will spawn in real time based on consumer’s intent and location… and they won’t just appear on devices. Let’s hope that point arrives soon. I really could of used that Grande Dark for the plane ride. Airline coffee may say it’s Starbucks, but it really doesn’t taste the same.