By Scott Gillum and Paige DiPrete

Modern marketers are “technology crazy,” constantly searching for the latest innovation to help them optimize the customer lifecycle and gain a completive advantage. For better or worse, marketers have plenty of options to play with, according to Scott Brinker the MarTech landscapes is enormous with 3,874 ISV’s and growing everyday.

In the past, Larry Ellison would of referred to the maturing MarTech space as a “killer field.” With the “Big 5” (Oracle, IBM, Salesforce.com, Adobe and SAP) swooping in like birds of prey picking off niche providers to fill out their product portfolio.

Marketers in the past would have been content with letting the industry leaders pick the winners and losers from this vast field of options. Preferring to consolidate their technology needs with one or two vendors making it easy to have “one throat to choke.” Companies like Oracle, have invested in making acquisition to fill solution gaps in functional areas as they have built their Marketing Cloud.

Unfortunately for Oracle and others, Millennia’s are not behaving the way traditional software buyers have in the past. In fact, there is growing evidence that they are pursuing a “best of bred” approach aimed at stitching together multiple platforms that follows the customer journey. Marketers are arranging their “stacks” either in a linked multi-platform approach, or with a spine in tag management products that hook up to an assortment of specific platforms and ISVs.

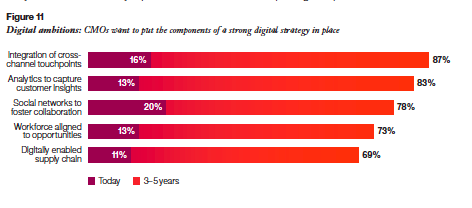

These new customer-centric clouds cut through traditional inefficiencies to motivate purchase intent. They are woven on the idea that consumers search for and choose customer-oriented brands, so marketing technology should reflect and enhance this in the evolving digital world. Most clouds only offer targeted suites in functional areas, which create both customer and internal silos. But these hybrid clouds humanize the digital experience and bridge integration seamlessly across all channels and touch points. All customer-facing departments are poised to address the public with a single strategy organized into one set of solutions.

A growing leader in the experience cloud space is Sprinklr, recently valued at $1.8 billion. Sprinklr has a focused acquisition strategy that concentrates on integration and is unlike any other in the business. First off, it doesn’t sweep up tools simply to increase their client base or rapidly grow, but it instead targets how well each can augment the customer’s experience. Sprinklr then completely rebuilds their software onto its own platform to ensure seamless integration.

And this could present a major challenge for the Big 5, as Oracle’s president Mark Hurd calls the idea of perfect integration between its products impossible, adding that, “There will never be a day where the depth of integration, unless it was all built from the bottom ground up, will be as integrated as any of us would like.”

When Sprinklr made its initial acquisition in 2014 of the Dachis Group, it was able to launch the first end-to-end operating system for brand marketing that enhanced customer relationships through multiple channels and touch points. Since then, its business ventures have made it a pioneer in converged media, advocacy, social communities, content management, audience segmentation, and social visualization – all to enrich its clients’ understanding of and engagement with customers.

Even though Sprinklr may be the fastest and most effective solution so far, it’s not alone in the move to deliver this new breed of experience clouds. In 2014, Gartner predicted that 89% of companies would be competing mostly based on customer experience by today, versus the 36% four years ago. The leading cloud giants like Oracle, IBM, Salesforce, and Adobe are starting to recognize this new wave and have shifted their strategies accordingly to offer their own experience clouds but integration remains a challenge.

Salesforce recently acquired Demandware as an integral part of its Customer Success Platform, but it yields weak integration between its various clouds. Similarly, Oracle and IBM are especially vocal about their experience cloud offerings and each present a large number of comprehensive solutions, but they are also limited on the integration front, both internally and with third party plug-ins.

It’s still debatable if there will eventually be “one cloud to real them all” but for now, the successful platforms will be those that can serve as a solid backbone through internal as well as external integration. Or as Sprinklr Founder, and CEO Ragy Thomas states it “Sprinkle, don’t shout. It’s not about who yells the loudest. It’s about who offers the most value in a relevant, nurturing way.”