Originally posted on August 11, 2010

Social Relationship Management and Social CRM are terms that are now being thrown around for new technology platforms that are enabling multichannel execution. Companies like Lithium Technologies have created platforms that allow companies to run hosted communities, listen across a variety of social media channels, and manage content to and from social networks in one integrate tool.

While marketing has steadily evolved from “one to many”, to “one to one“, Social CRM is now creating the opportunity for “many to one.” For example, a customer tweets a question about a product (e.g. is it worth the money) on Twitter, a customer advocate brings that comment into the company’s online forum. Customers response to the question by sharing their experiences with the product, those comments (most likely only the positive ones) are then tweeted by the company to promote the product.

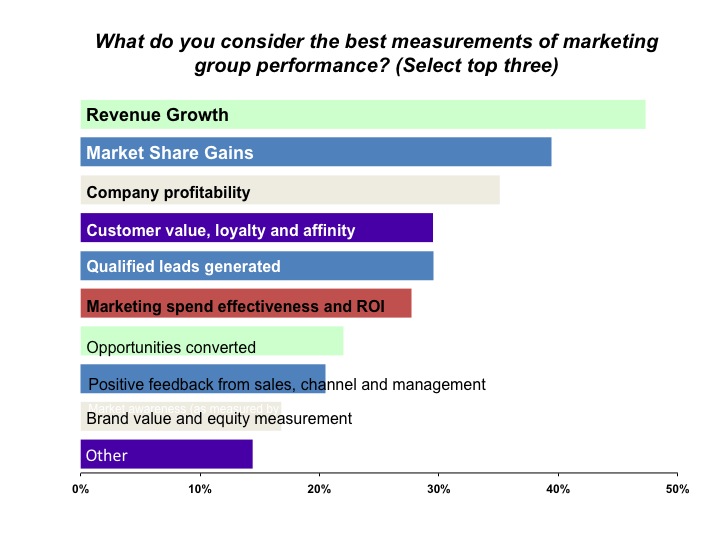

The promise of Web 2.0 has always been about customers selling to customers. New Social CRM tools are now enabling that by consolidating platforms. But this has the potential to raise issues over who gets credit for the sale. If the true ROI on social media is revenue, which many research studies are now suggesting, then who should gets credit for a sale closed by a customer advocate?

Customer references and testimonials have always been critical for closing deals. What happens when customer advocates volunteer their support for the brand and/or endorsement of a product? Does marketing get credit for providing platforms for enabling customer advocates? And what about the customer/s who’s comments help push the prospect over the goal line…do they need to be rewarded, and if so?

One thing is certain: social media is blurring the line between sales and marketing interactions and dialogues. Given that, we may have to rethink our traditional views of customer coverage and relationship management. Perhaps in the future, marketing will be responsible for managing customers online relationships, and sales for the offline experience.

Someone call HR and give them the heads up. Territory planning, revenue crediting, roles and responsibilities might need a refresh soon.