John Wanamaker was an innovator, a merchandising, and advertising genius. But when he made the statement; “Half the money I spend on advertising is wasted, the trouble is wasted, the trouble is I don’t know which half.” He left legacy that has haunted marketers ever since.

New research from CSO Insights suggests that the day may have come for sales. In their annual Sales Performance Optimization study of over 1500 companies across multiple industries, CSO found that the accuracy of sales forecasting fell to a near all-time low of 46.5%. Or as John Wanamaker might say; “Half of your sales efforts are wasted, you just don’t know which half. “

And since the forecast, defined in the study as near-term (30, 60 and 90 day), is an output of the sales pipeline, one could also conclude that half (or more) of the pipeline is “junk.”

With the wide spread adoption and utilization of CRM (84% of the firms surveyed), marketing automation, and analytical forecasting tools, the question is how can this be?

Here are some thoughts on why this might be happening, and five tips to help you improve your forecast.

Reasons for poor forecasting:

- Impurities in the System – let’s go after the big one first. “Garbage in, garbage out”…as they say. There’s a laundry list of things to look for — from reps putting leads in the system right before they close, to not updating opportunity consistently, and leaving in dead leads too long.

- Sales Optimism – yes, the economy seems to be recovering but it may not be moving at the “speed of sales.” Sales folks are an optimistic bunch; they want to believe things are better than they may be in reality. For example, the average length of the sales cycle. In a report earlier this year by BtoB Magazine, 43% of marketers reported that the sales cycle had increased over the last 3 years. Which is consistent with the CSO Insights report where 42% of Chief Sales Officers stated that the sales cycle had lengthened, in particular with new acquisitions.

- Incentives & Goals – take a look at how reps are being incented, and/or their sales goals. You may find the reason why reps leave opportunities in the pipeline too long, and/or are over optimistic with their forecast. Pressure to build and maintain pipeline can sometimes cause counter productive behaviors.

- Gut Feel – even if the troops in the trenches are putting in accurate and timely data, the generals may change it to fit the political environment and/or their own personal bias.

- Changing Buyer Behavior – recent research has shown that the buyer’s journey, and the typical sales process are not aligned. Buyers frequently start and stop the journey, or will cycle at a stage, and even move backward in the process. CRM systems are typically designed in a linear approach, progressing from a lead to a close. It’s an internal view, and increasingly out of alignment with buyers’ preferences.

How to improve:

- Active Pipeline Management – The pipeline and forecast will never be 100% accurate. That said, you should have a feel for how far off it is, and what is needed to improve. For example, do you have an inspection process to keep the pipeline current? If so, consider doing it more frequently. Move quarterly reviews to monthly. Also, if everyone is responsible for updating the pipeline, then no one is responsible. Consolidate the “maintenance and hygiene” of the pipeline to one person. Others may be responsible for providing updates, but one person needs to police the system.

- Discount Probability and Value – conduct a post-mortem on past forecasts over last year or two. Assess the difference between forecasted and actual results. Create discounted probabilities based on that delta for: lead movement (from stage to stage), and lead value. If implemented, evaluate the accuracy of your “pre-set” discounts. It should help bring forecasts more in-line and ground “sales optimism” in a bit of reality.

- Govern the Process – to improve the accuracy of “output”, focus on implementing and managing a standard process. Accenture’s Connecting the Dots on Sales Performance found inconsistencies among reps in using their company’s defined process and methodologies to selling. A quarter of Chief Sales Officers surveyed stated that sales reps used their sales methodologies 50% of the time, 31% said it was used 75% of the time.

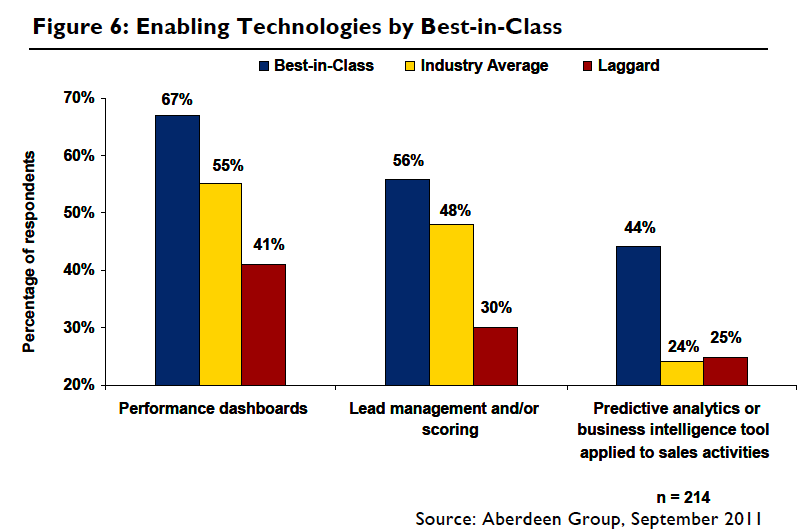

- Leverage Marketing – close the feedback loop with marketing to improve the quality of leads from campaigns and activities. In a report on Sales & Marketing Alignment by the Aberdeen Group, marketing accounted for 47% of the sales forecasted pipeline in the Top 20% of companies studied, compared to only 5% of laggard organizations (bottom 20%).

- Utilize Business Intelligence Tools – high penetration rates of CRM may equate to high visibility, but doesn’t automatically mean that it provides the best insight. Despite high adoption rates of performance dashboard, few companies are using business intelligence or analytics tools according to the Aberdeen Group report on sales forecasting. However, the report found that 44% of the highest performing sales organizations were using predictive analytics to reduce “gut feel” in the forecast.

Of all the options, perhaps the best lever for impacting accuracy is the rep. As Ashish Vazirani, a Principal in the Hi-Tech practice of the sales consultancy, ZS Associates says; “A sales person needs to be coached, or apprenticed on how to discern and input the right information for accurate forecasting. Technology can make us lazy and reliant on the tools to do the thinking, we need to emphasize the importance coaching plays in keeping the garbage out of the system. ”

Helping the troops become better soldiers through coaching should help improve the accuracy of the forecast. As well as, implementing the tips mentioned above. But you may still find that half of the pipeline is wasted, but hopefully, unlike Mr. Wanamaker, you’ll understand which half.